arizona charitable tax credits 2020

New Look At Your Financial Strategy. Is here a deadline for my tax credit contribution to be made by.

If youre married filing jointly the amount is 800.

. Visit The Official Edward Jones Site. There are four 4 steps to document your donation and claim your tax credits. The process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward.

In Arizona instead of reducing the amount of taxable income the state charitable tax credit policy reduces your overall taxes. For 2019 Mary is allowed a maximum credit of 400. Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 2223015 Hands Hearts Inc 8380 N Fleming Dr Flagstaff AZ 86004 928 310-0947 202661st Way Pregnancy Center PO Box 5294 Phoenix AZ 85016 602 261-7522 20075A New Leaf Inc.

10 rows Arizona Small Business Income Tax Highlights. Check out some resources to help you get the guidance and support you need. Lets Partner Through All Of It.

2022 Brighter Tomorrow Virtual Event. 1 Best answer MarilynG1 Expert Alumni February 5 2020 311 PM For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify. With a 3 tax rate you would owe 1173 in taxes.

For 2020 theres also a special rule allowing you to deduct up to 300 of charitable contribution even if you dont itemize. SCNM Sage Foundation is a Qualified Charitable Organization QCO eligible for the Arizona Charitable Tax Credit. There are four steps to document your donation and claim your tax credits.

Arizona Qualified Charitable Organizations Maximum of. 800 Married filing jointly 400 filing Single LEARN MORE Qualified Foster Care Organization. In AZ a taxpayer will get a 25 increase to the Standard Deduction for charitable donations not claimed on the Federal return because they did not itemize.

800 Married 400 Single Qualifying Charitable Organizations. Maintain a receipt of your gift from the charity in order to provide a copy with your tax return. Here is a great example from the Arizona Department of Revenues website.

For Qualifying Foster Care Charitable. Qualifying Charitable Organizations and. Donate to a qualified charitable organization QCO or QFCO such as a 501 c 3 organization like Gompers.

The Arizona taxpayer must first donate the maximum for the original School Tuition Organization Tax Credit 1186 for married filing joint and 593 all other taxpayers in order to donate an additional amount for the PLUS Switcher tax credit. Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly. When you take a tax deduction for charitable giving the amount you give is subtracted from your taxable income.

The Arizona Department of Revenue ADOR advises taxpayers they have until May 17 to make donations to qualifying charitable organizations to claim the tax credits on their 2020 individual income tax return. Marys 2019 tax is 250. 2020 Arizona Tax Credits You may receive a dollar-for-dollar tax credit for contributions to the following types of charitable organizations.

High Holiday Food Drive. The maximum PLUS Switcher credit amount that may be taken for tax year 2020 is. Its fast its easy and with the tax credit its free.

868 E University Drive Mesa AZ 85203 480 969-4024. 1243 filing Single LEARN MORE Qualified Charitable Organization Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. Complete the relevant tax form to claim one or more credits.

Mary can apply 250 of the credit to her 2019 tax liability and carryover 150 of the unused 400 credit to. The Arizona Foster Care Tax Credit allows you to reduce your tax bill dollar-for-dollar up to 500 for a single person 1000 for a couple by the amount of your gift. Find A Dedicated Financial Advisor.

Taxpayers with charitable donations including Cash Non-cash as well as Qualifying AZ Tax Credit donations will benefit if their AGI exceeds the Standard Deduction for their filing status. In order to receive credit on their 2020 tax return taxpayers must make their Private Education Tax Credit contribution by. Ad signNow allows users to edit sign fill and share all type of documents online.

You can provide free healthcare for those in need at no cost to you. Life Is For Living. This was designed as an incentive for more people to support charities hurting during the pandemic.

For Tax Year 2020 single filers can direct up to 1183 and joint filers can direct up to 2365. You can do it today. When you invest 1500 in parent aid you provide weekly in-home support to a family for a full year which will have lasting impacts not only on the parents and children but the greater community as well due in part that every dollar invested in our home-visitation program will be returned to our community 15-fold in decreased costs to the child.

This credit is limited to the amount of tax calculated on your Arizona return. Click the link for detailed info at the Arizona Dept. Donate to a certified charitable organization QCO or QFCO such as a 501c3 organization like St.

If you earned 40000 and donated 400 to FSL and 500 to a foster care organization a tax deduction policy means your income is considered to be 39100. If youre single head of household or married filing separately the maximum tax credit amount is 400. Create Legally Binding Electronic Signatures on Any Device.

During 2019 Mary a single person gave 600 to a qualified charity.

Charitable Giving Incentives Plus Switcher Credit Tuscon Phoenix Az

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Arizona Tax Credits Az Tax Credits 2020 Price Kong

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Youth Partnership Is A Member Of Give Local Keep Local Azyp Arizona Youth Partnership

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Give To Nac An Arizona Qualifying Charitable Organization Native American Connections

Arizona Charitable Tax Credit For Southern Arizona Home Facebook

Arizona S 2020 Charitable Tax Credits Henry Horne

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Tax Credits Mesa United Way

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

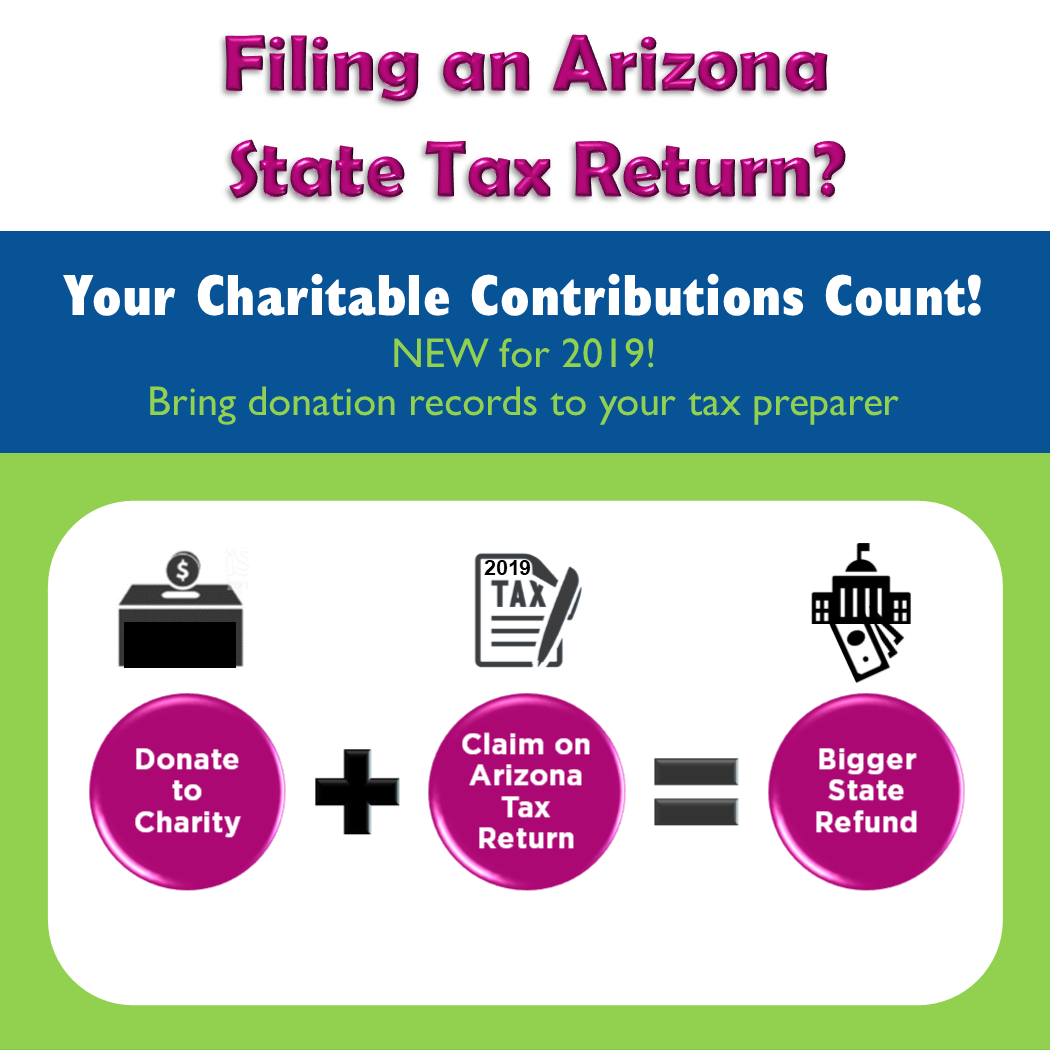

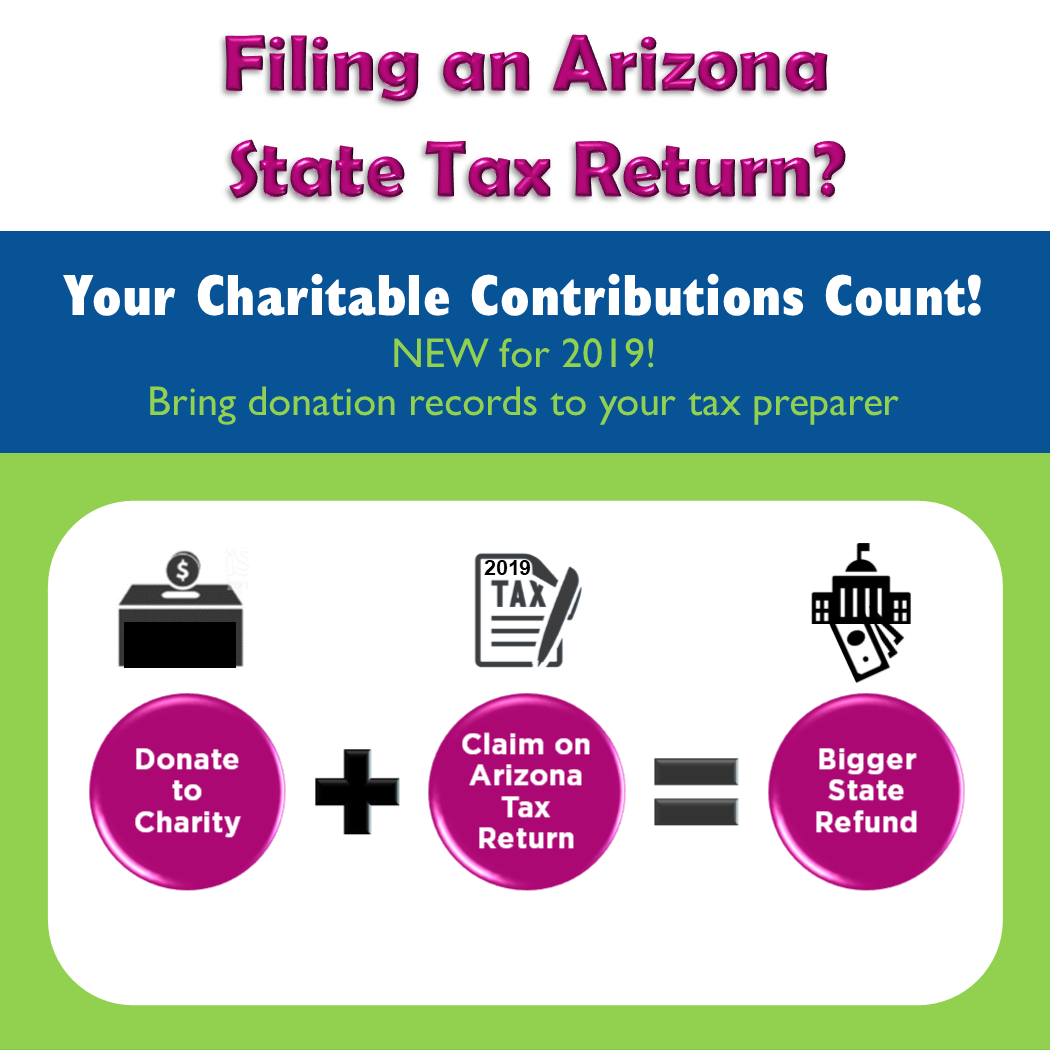

Charitable Contributions Count In Arizona Tempe Community Council

Tax Credits For Donations To Area Groups And Schools Local News Paysonroundup Com

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

List Of 6 Arizona Tax Credits Christian Family Care

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis